(Updated on 12 December 2018)

Recently, one of our Facebook followers responded to my article on the origin of Lincoln Yards and the associated tax-increment financing (TIF) district, writing:

"What is missing from publicly disclosed documents are estimates for the amount tax revenue that this project can be expected to generate over the 23-year (more if it's extended) life of the TIF . . . How much in property taxes beyond the estimated $800M for proposed infrastructure improvements that would go into a discretionary (slush) fund under the control of the mayor?"

Chicago Dept. of Planning and Development estimates,

totaling $700M, of infrastructure spending in the

Cortland/Chicago River TIF district.

Source: city of Chicago's 11/14/18 public meeting.

The one thing—and the only thing—we know about the estimated tax revenue from publicly disclosed documents is the amount: $800 million. This figure comes from a FAQ sheet distributed by the Chicago Dept. of Planning and Development at its Nov. 14, 2018 public meeting on the Cortland/Chicago River TIF district.

I think the writer's larger implication is correct: The city has not provided any material to show on what it based that estimate.

Presumably, planning department analysts looked at the potential 23-year life of the proposed TIF district and did the following.

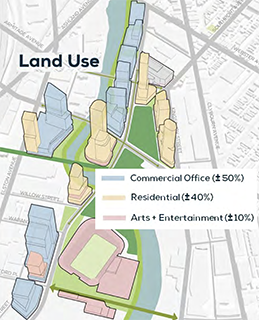

- Estimate the number, size, density, and uses of all the buildings that might get built.

- Assign an equalized assessed value (EAV) of all the properties identified in #1, for each year of the TIF district's life. Sum them over all the years.

- Identify the EAV of all the properties present at the TIF district's inception. Multiply that by the number of years of the TIF district's life.

- To get the total tax increment accumulated by the district, subtract #3 from #4 and multiply by the tax rate.

Sterling Bay's 11/29/18 update of the proposed Lincoln

Yards building layout. Source: Sterling Bay.

The city hasn't disclosed any of that. Planning department officials did, however, show how they'd spend up to $700 million of the estimated total TIF take (see "Key Public Infrastructure Needs" above).

Some clues about the calculations appear in the TIF district's redevelopment agreement—a document that planning officials said at the Nov. 14 meeting they'd release "in three weeks," but that the city's Web site revealed on Dec. 12.

Another wrinkle: The Lincoln Yards development will comprise an estimated two-fifths of the TIF district. The developer of Lincoln Yards, Sterling Bay, has not made publicly available a detailed list of the projected number, size, density, and uses of all the buildings in Lincoln Yards. Though an enterprising researcher could extrapolate some (or much) of it from the aerial renderings that Sterling Bay's presented at a Nov. 29 public meeting, no one has tried . . . yet.